Receivables Finance: Powering the Paygo Sector with Liquidity Solutions

Pay-as-you-go (Paygo) is a credit system that enables consumers to gradually acquire solar lighting systems and clean energy equipment, rather than requiring upfront payment for the product. By removing the financial barrier to access to energy , it paves the way for wider energy adoption, including for unbanked or underbanked populations.

As we delved into the challenges and perspectives of capital for Paygo at the last-mile in our previous article, we introduced receivables financing as a noteworthy contender for a viable financing solution. Bringing capital to companies through their invoices has the potential to solve cash-flow challenges underlying Paygo, boost the profitability of the sector and make this credit model more sustainable for businesses. What exactly is it, where do we stand, and what will it take to take the approach at scale?

What is Receivables Finance?

A company which extends credit over invoices to its customers will record outstanding amounts as assets on its balance sheet, under the name of accounts receivables. While it comes with strong commercial benefits, long collection periods can jeopardise a company’s cash flow position and, consequently, its ability to function – especially in times of liquidity crunch. In receivables financing deals, companies raise funds against their outstanding invoices. By doing so, they access liquidity that would otherwise be tied up in future payments.

Receivable financing is traditionally structured either as assets sales or loans:

In invoice financing, the receivables are used as a collateral for a loan. The company gets a cash advance based on the nominal value on the receivables and pays interest accordingly.

In receivables factoring, the receivables are sold off at a discount to a finance provider prior to the invoice maturity. No interest expenses are paid, since this is a sale and not a loan. The finance provider makes a profit on the principal to value spread, and on the fees applied to the transaction. Receivables factoring can be structured off-balance sheet: performed with control and transparency, this can be a good way for companies to raise funds without deteriorating their ratios or credit scores.

Receivables factoring is our main focus here - considering the liquidity constraints of Paygo companies, as well as the benefits that could come from opening de-risked investment opportunities through asset sales. If you’re curious to refresh your knowledge of those challenges, feel free to watch our recorded webinar on the topic.

Worldwide, examples of industries where receivables factoring has been used do not lack. From manufacturing to transportation or construction, any business is susceptible to use receivables financing to manage the cash flow challenges that come with long project cycles. In 2020, the global factoring market represented next to €3bn worth of transactions. Some geographies displayed significant activity, with nearly €2bn of factoring transactions recorded in Europe and $687 million in Asia Pacific (Source: Factors Chain International*).

Why is Receivables Factoring a fit for Paygo companies?

Generally speaking, factoring can be seen as a win-win deal for investors and businesses:

For the seller of receivables, it is a reliable way to optimise working capital and access trapped liquidity without increasing insolvency risks. As end-customer payments are turned into repayments of investors, cash flow positions improve and leave room for businesses to focus on operations and healthier growth.

For the fund provider, receivables financing can open access to a new profile of companies and unlock attractive investment opportunities, with tailored risk/reward ratios.

Applied to the off-grid solar industry, one quickly sees how receivables financing is a relevant answer to the liquidity and profitability challenge faced by most Paygo companies. Medium to long term credit is the lifeblood of the Paygo / SHS sector. It has shown tremendous benefits in powering bottom-of-the-pyramid populations with reliable energy. From a business perspective, however, significant amounts of pending invoices are funds that cannot be used to finance operations. As liquidity is trapped in the books, Paygo companies borrow to finance the credit they offer to customers- shrinking, in turn, their perspectives for profitability.

Instead of exacerbating cash flow imbalances, receivables factoring embraces the core business model of Paygo companies - one where retail meets consumer finance in long-term outstanding invoices. It can be a sustainable financing solution for Paygo distributors.

Receivables factoring is already present on the continent, and there have been a few initiatives within the industry; yet, there remains a dearth of widely accessible solutions.

Factoring and Paygo: Where do we stand?

For context, it's important to note that Africa is still in the early stages of its receivables factoring market. In 2020, the continent's factoring volume amounted to only €24M (Source: Factors Chain International*), representing a mere 1% of the global market. North Africa, South Africa, and Mauritius are the primary players in the broad factoring industry in terms of volumes, with some countries such as Senegal, Zambia or Kenya currently catching up.

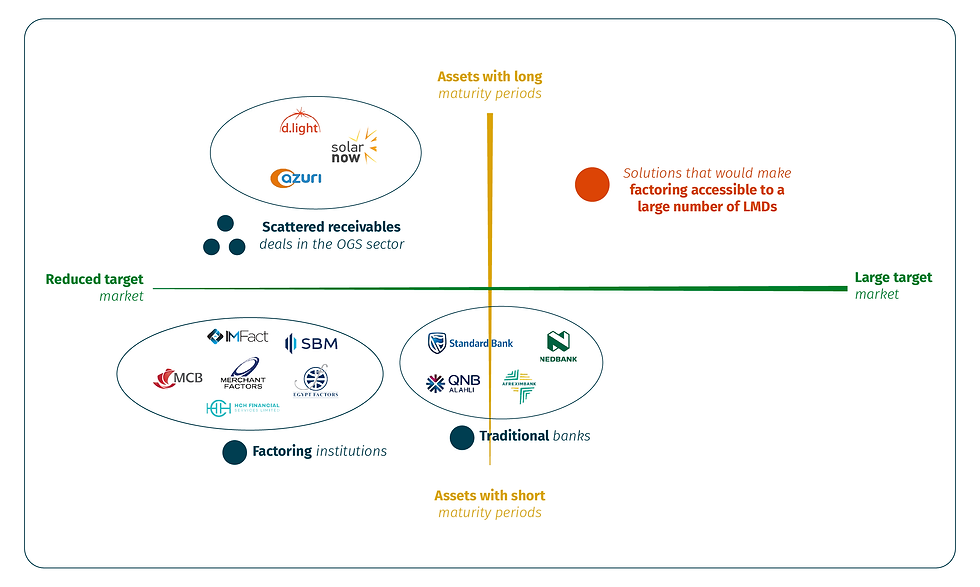

In that nascent ecosystem, financing institutions and banks are leading factoring initiatives for African businesses. However, they rarely target credit terms as long as in the Paygo industry - cash collection period generally ranges from 90 to 120 days. In addition, they often operate within a limited geographic scope, with solutions targeted at domestic companies mostly.

The off-grid solar sector has had to create its own opportunities for receivables financing. These deals may have yielded conclusive results, but they have been scattered across the continent and focused on single major players. Several factors contribute to these limitations:

Historically, the non-standardized nature of data has made asset analysis complex - reducing investors’ incentives to carry out such assessment on small capital volumes

More broadly, whether on due diligence or banking fees on repayments, transaction costs have made small deals less viable and sustainable for financiers. This has fueled an exclusion effect, creating barriers to entry for smaller distributors.

The industry also needed to experiment with receivables factoring in a pilot mindset before bringing it at scale. Industry-wide coordination of players is only starting to materialise.

Consequently, there remains a gap to be filled, with solutions that would have the potential to scale receivables factoring and bring capital toward the largest number of distributors.

Scaling Receivables Factoring for Paygo: What will it take?

The key drivers that will lay solid foundations for factoring to bring long-lasting answers to Offgrid Solar financing pain points can be ranked into three categories: organisational, technological and environmental.

1. Organisational factors

Upstream aggregation of capital: Pooling of capital would help to create better fitted financial instruments by blending different types of capital and contributing to the standardisation of financial analysis methodologies or securitization approaches. Having larger entities carrying out factoring deals would come with larger volumes of investment which, in turn, would open cost-effective opportunities on transactions - including lower discount rates and cheaper currency hedges. As investors with different risk appetites come together, costs would shrink and capital efficiency would improve, both from a return and impact perspective.

Downstream aggregation of assets: If factoring transactions happen off-balance sheet, they can be securitized, meaning that assets from multiple companies are bundled together before they receive financing. This could substantially lower risk, costs and entrance investment ticket size, making receivables financing available to a wider audience.

Back-up servicing: Developing insurance mechanisms that will further decouple asset and company risk will be pivotal to lower transaction risks. If recovery guarantees are strengthened, investors’ trust in factoring will improve and larger volumes of capital will be poured into such initiatives.

2. Technological factors

Data standardisation: Financial, operational and impact data harmonisation across companies will greatly facilitate standard asset analysis and lower factoring transaction costs.

Automation and simplification of transaction tracking: solutions that help automate and simplify financial management and analytics on transactions will be key to taking initiatives at scale. This gets even more relevant as transactions involve more aggregation across companies, larger investment volumes or accentuated geographic spread. The more complex the transaction, the more complicated and prone to error monitoring and reporting becomes. Digital solutions have been quoted as key drivers to accelerate the spread of factoring in the most advanced African countries in that segment. They include:

- Secured platforms and tech solutions for live monitoring of the financial performance of assets. Considering that credit under Paygo is extended over months if not years, it is essential for financiers to be able to monitor performance threshold and effectively track repayments over time, to quickly flag any deterioration in portfolio quality.

- Payment and banking automation solutions, to minimise transfer risks or costs and facilitate financial management

3. Environmental factors

Awareness: Companies should be given the tools to realise that growth and financing should not exclusively come from loans or equity. If distributors’ demand and appropriation over the method grow, nascent initiatives will have an easier time rooting themselves in the ecosystem and triggering industry-wide changes.

Regulation: Conducive legal and regulatory frameworks will give impetus for a sustainable development of receivables factoring (clear definition and credit categories, conducive securitization frameworks…). This goes hand in hand with favourable taxation laws, which can push down transaction costs. Beyond private players, support from regulatory bodies would help create robust factoring environments.

Coordination: Individual factoring initiatives are vital, but they will not be sufficient to trigger industry-level changes alone. This will not be a winner takes all situation, and more than one initiative is needed to bring forward necessary change. Advancing the agenda of receivables factoring will take collective efforts toward complementary solutions, knowledge sharing, as well as joint policy dialogue and advocacy in local contexts.

What's next?

Down the road, any discussion about capital for the offgrid solar industry is one about financing access to energy for last-mile customers still left out of the SDG7 equation. Receivables financing is a robust answer to the challenge of streamlining cheaper capital in larger volumes toward companies serving unbanked populations on credit. Under the right circumstances, it has a strong potential for success.

With Bridgin, we hope to contribute by building a key infrastructure within the receivables financing value chain. Tech and legal solutions power our receivables marketplace, which aims at fast tracking transactions and reducing costs to democratise this promising approach to finance. Whether you are an investor willing to enter the game or a distributor searching for new avenues of growth, we have solutions to offer. Reach out to [email protected]; we’d love to talk more.

*Source of the factoring figures: Factoring in Africa to support trade development (acbfpact.org)

---

Distributor? Investor? Development partner? If you’re interested in getting more information about Bridgin, please reach out to our Fintech Business Lead via email at [email protected]. Stay tuned for more resources on Bridgin and receivables finance!

About Bridgin

Bridgin is Masunga's Receivable Financing Solution. Conceived as an online trading platform for accounts receivables, it allows distributors of essential services to unlock liquidity over assets through the sale of their outstanding invoices to investors, offering investors a unique chance to tap into a previously untapped asset class at a lower risk.